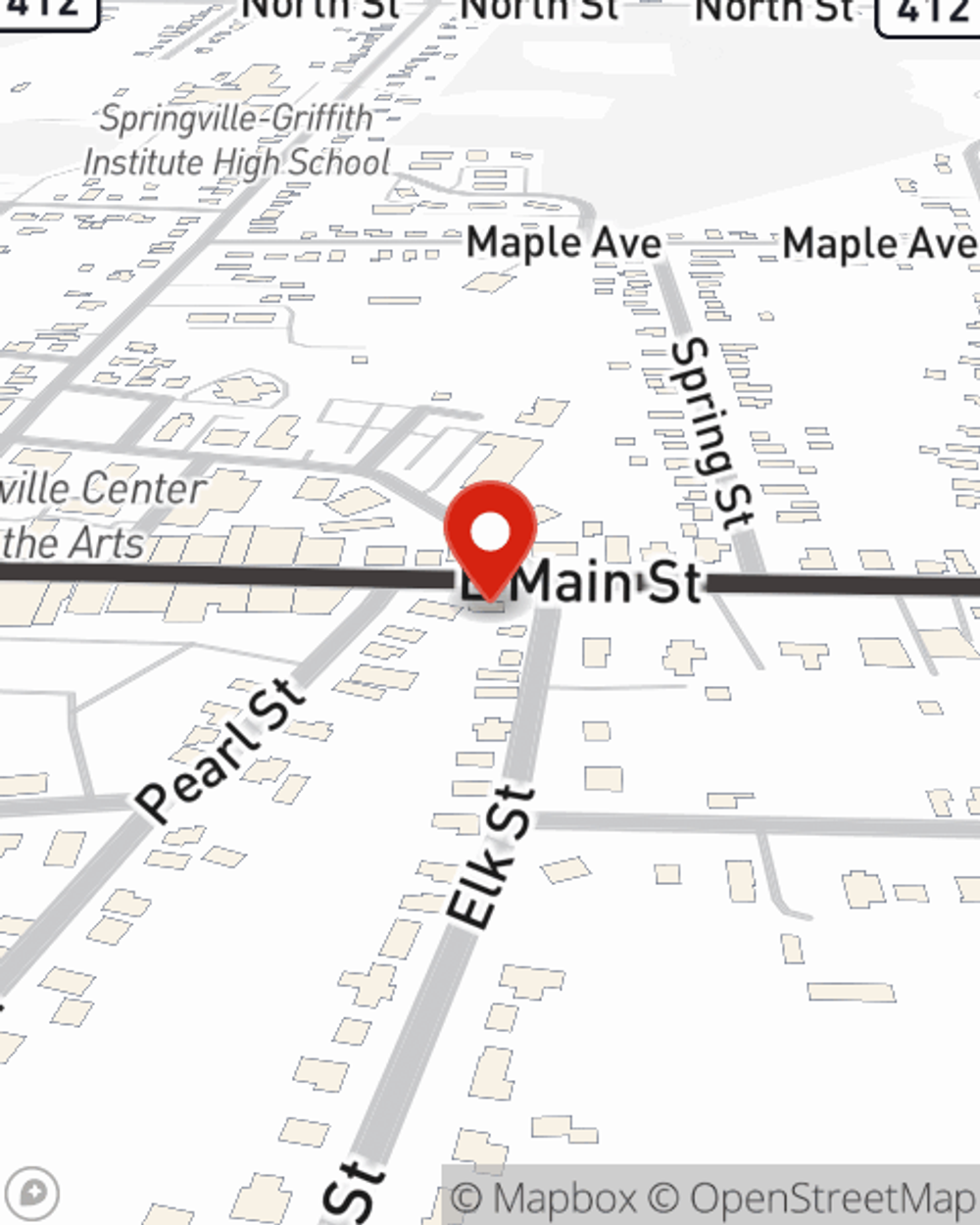

Business Insurance in and around Springville

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Insure The Business You've Built.

Preparation is key for when the unexpected happens on your business's property like a customer hurting themselves.

Looking for small business insurance coverage?

Helping insure small businesses since 1935

Strictly Business With State Farm

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like errors and omissions liability or a surety or fidelity bond, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Jim Merenick can also help you file your claim.

Curious to research the specific options that may be right for you and your small business? Simply reach out to State Farm agent Jim Merenick today!

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Jim Merenick

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.